In one month, only consumer credit showed growth, with an increase of 78.7 million BAM. These are August data from the Central Bank of Bosnia and Herzegovina. BHRT investigated what citizens are using personal loans for and why an increasing number of people are taking them.

Oglas

Due to a small pension, Cica Bosnic from Banja Luka was forced to take out a 5,000 BAM consumer loan. She says this will be the last time, as it's not worthwhile due to high interest rates.

"Strictly for survival, because my pension is small, 428 BAM after 30 years of service. The interest is high, the money is spent quickly, and in the end, you have nothing left," says Bosnic, according to BHRT.

Autumn is the peak time for consumer loans. For a large number of citizens, consumer loans are the only way to survive.

The Consumer Movement of Central Bosnia points out that not only low-income citizens are taking out consumer loans, but also those with average incomes. They attribute this to the multiple increases in the cost of living over recent years.

"Unfortunately, people are taking small loans purely to get through the year, especially winter, as this is the time when children are prepared for school, winter supplies are stocked, and fuel for heating is purchased. More and more citizens are resorting to loans as their only means of survival," says Admir Arnautovic, president of the Consumer Association of Central Bosnia.

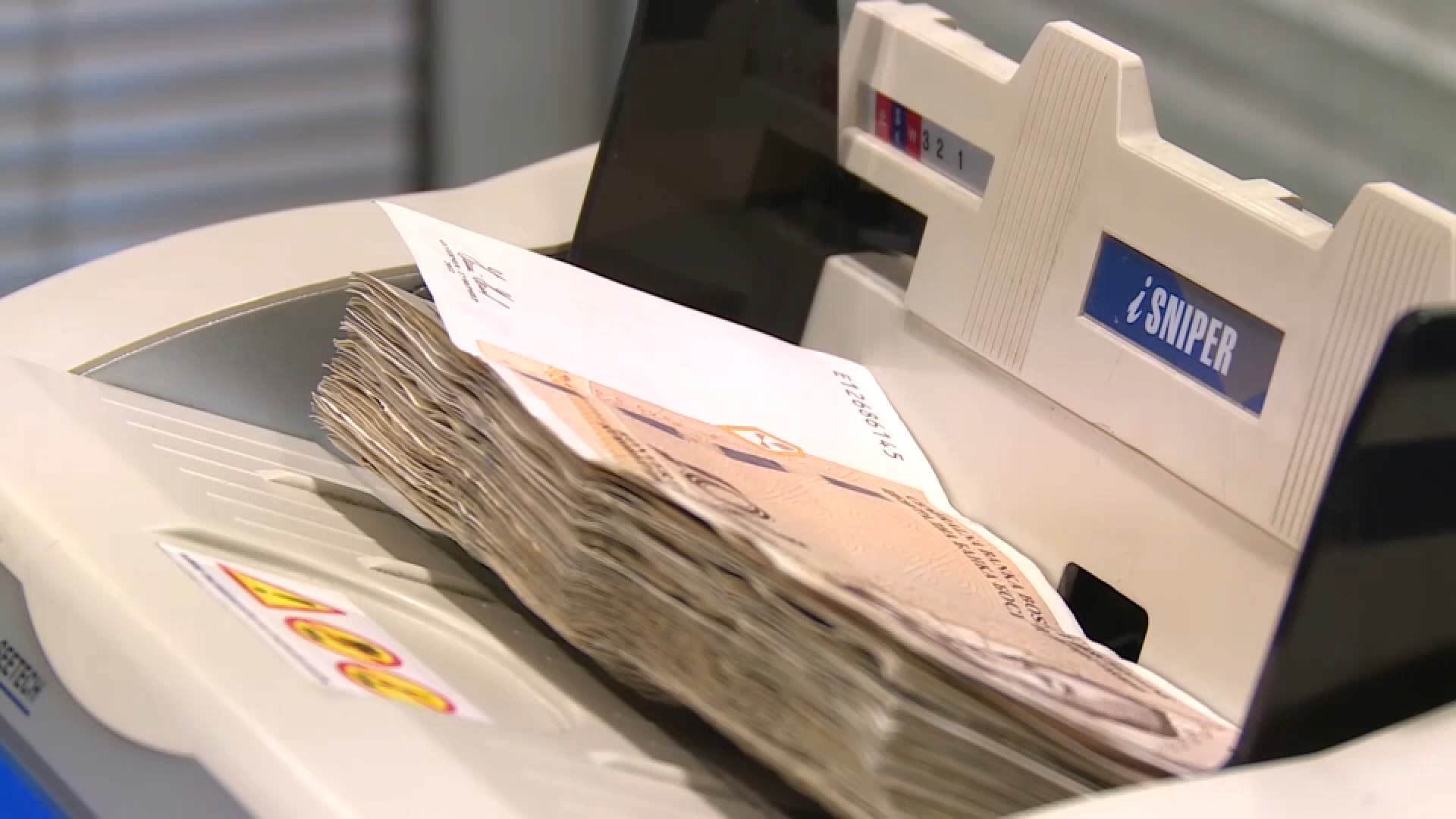

Data from the Central Bank of Bosnia and Herzegovina shows that total loans in August amounted to 25 billion BAM, which is 34.9 million more than in July. A rise in consumer credit was recorded.

"Credit growth was recorded in the consumer sector by 78.7 million BAM, while a decrease in credit growth was noted in other sectors," reports the CB BiH.

Economists see the decline in demand for purpose-specific loans as a result of bank requirements, which include registering property as collateral, while unsecured loans do not require such guarantees.

"Consumers and a small portion of businesses have turned to unsecured loans because they avoid additional collateral requirements imposed by banks," says Marko Djogo, dean of the Faculty of Economics at the University of East Sarajevo.

Consumer loans are relatively quickly approved. For those with higher credit risk, the interest rate is higher than for those with lower credit risk. A large number of citizens are forced to take out loans for bare survival, despite the unfavorable interest rates.

Kakvo je tvoje mišljenje o ovome?

Učestvuj u diskusiji ili pročitaj komentare

Oglas

Kakvo je tvoje mišljenje o ovome?

Učestvuj u diskusiji ili pročitaj komentare

Oglas

Srbija

Srbija

Hrvatska

Hrvatska

Slovenija

Slovenija